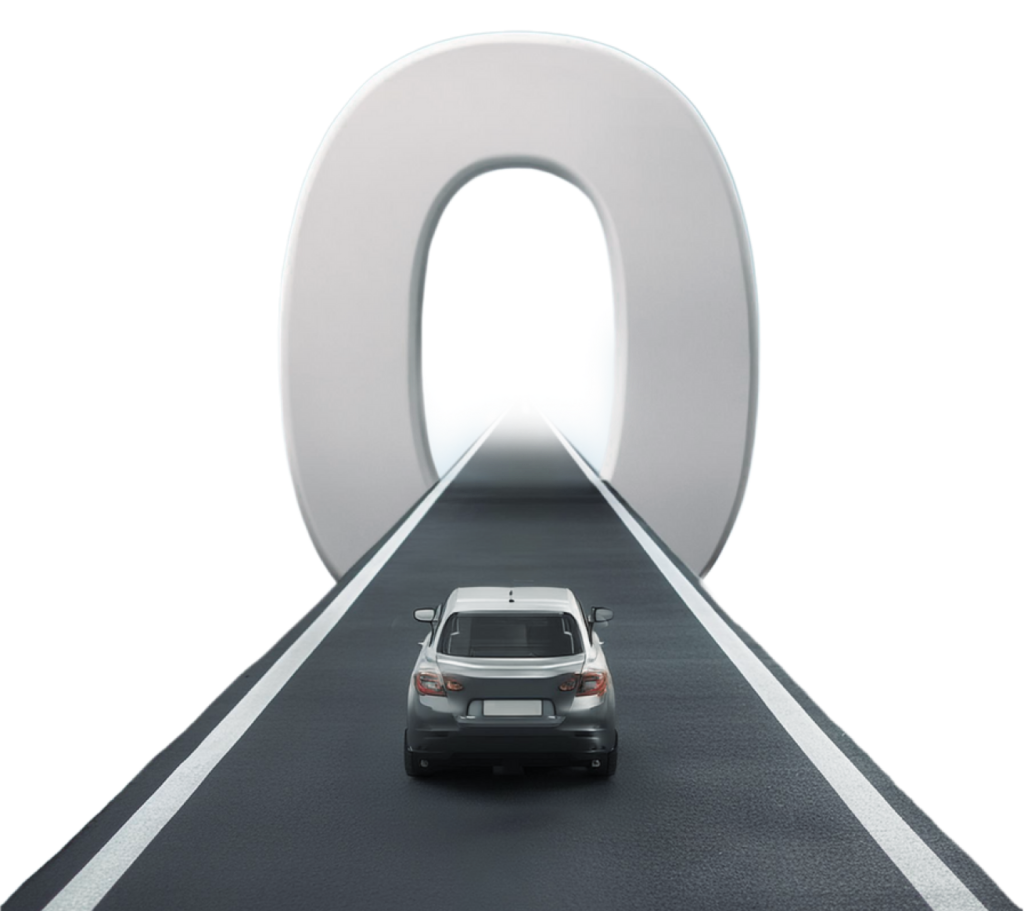

Accidents are expensive and auto-insurance might not cover everything.

Eliminate unexpected cost with Insurio’s auto-excess coverage.

100%

Driver Protection

Fully Protected

Our Excess Protect Plan guarantees 100% financial protection against unforeseen and excessive expenses in the event of an accident.

Driver First

Our main focus is providing total driver protection, ensuring you’re covered 24/7, regardless of the vehicle you drive.

Globally Covered

Our Excess Protect Plan guarantees complete protection at all times and in all places whenever you are behind the wheel.

Fully Protected

Our Excess Protect Plan guarantees 100% financial protection against unforeseen and excessive expenses in the event of an accident.

Driver First

Our main focus is providing total driver protection, ensuring you’re covered 24/7, regardless of the vehicle you drive.

Globally Covered

Our Excess Protect Plan guarantees complete protection at all times and in all places whenever you are behind the wheel.

Who Should Have

Excess Protect?

WITHOUT EXCESS PROTECT

WITHOUT EXCESS PROTECT

Got Question? Here are the Answers:

Got Question?

Here are the Answers:

Who can buy Excess Protector

As long as you are a driver and accident excess will be applied after you had involved in an accident, you are eligible to enter into the Smart Contract. However, you have to complied with the age limitation.

If i choose a level of coverage that matches the excess pedgged to my vehicle insurance policy, does it mean that I don’t have to pay a cent in the event of an accident?

Yes. Driver shall fully paid the excess to the collection parties and submit a claim later.

Can i upgrade or downgrade my Smart Contract at any time?

Yes. You can upgrade your Smart Contract but you cannot downgrade your Smart Contract.

How do I choose an appropriate level of coverage for Excess

Every driver has a different level of excess pegged to his. her insurance policy or rental agreement. Choose a level of coverage that is the same as that of the exess of your car insurance or rental agreement.

Can i buy Auto Excess as a standalone policy?

No. You must have a valid car insurance policy to enter into Smart Contract because the product provides coverage for the excess you are responsible for.

Will my Smart Contract Fee for Excess be affected after an accident?

Yes. Your Smart Contract Fee will be affected if you are liable for an accident and submitted the excess claims.

How do i change my personal details on my Smart Contract?

To update your personal details on your Smart Contract, simply navigate to our Insurio app. Once there, locate your contract details and proceed to request the necessary amendments.

I lost my Smart Contract Documents, how do i get another copy?

How do I submit a claim?

Please follow the Claims Submission Step in Your Mobile Application. You may download from Apple Store or Google Play Store.

How is my personal data being used?

Your personal date is used to process and administer your Smart Contract. We also use your contact details to manage commnunications between us if we need to let you know about something importaing pertaining to your Smart Contract. This includes dealing with claims, responding to your enquiries or sending you your Smart Contract documents. For more information on how Insurio manages your personal data, please refer to (hyperlink on personal data protection notice).

How do i cancel or make changes to my Smart Contract?

To cancel or make changes to your Smart Contract, proceed to our contract details. Follow the provided cancellation or amendments instructions to continue with your request.

Voices of Satisfaction

"After my car was severely damaged in an accident, the repair costs exceeded my standard insurance coverage. Excess Protect covered the additional expenses, ensuring that I didn't have to dip into my savings. It's an excellent product that provides true peace of mind."

"Excess Protect has been a lifesaver for me. When I was involved in a major accident, the unexpected costs were overwhelming. Thankfully, with Excess Protect, I didn't have to worry about the large out-of-pocket expenses. It truly provided the financial security and peace of mind I needed during a stressful time."

"Excess Protect has been a lifesaver for me. When I was involved in a major accident, the unexpected costs were overwhelming. Thankfully, with Excess Protect, I didn't have to worry about the large out-of-pocket expenses. It truly provided the financial security and peace of mind I needed during a stressful time."

-

Damien Steele

After my car was severely damaged in an accident, the repair costs exceeded my standard insurance coverage. Excess Protect covered the additional expenses, ensuring that I didn't have to dip into my savings. It's an excellent product that provides true peace of mind.

-

Emily Cooper

Opting for Excess Protect was one of the best decisions I made. When I was involved in a collision, the costs went beyond the limits of my primary insurance. Excess Protect covered the gap, saving me from significant financial strain. I highly recommend it to anyone who drives.

-

Damien Steele

Excess Protect has been a lifesaver for me. When I was involved in a major accident, the unexpected costs were overwhelming. Thankfully, with Excess Protect, I didn't have to worry about the large out-of-pocket expenses. It truly provided the financial security and peace of mind I needed during a stressful time.

-

Emily Cooper

Opting for Excess Protect was one of the best decisions I made. When I was involved in a collision, the costs went beyond the limits of my primary insurance. Excess Protect covered the gap, saving me from significant financial strain. I highly recommend it to anyone who drives.

Insurio’s Excess Protect Here’s What Set Us Apart:

Powered by Blockchain

Blockchain technology is applied to provide secure and seamless claim processes. The use of smart contracts automate agreements, providing instant results without intermediaries or delays.

DIY Claim System:

Process Your Own Claim

Upload Document

Acknowledge Agreement

Real-time Claim Tracking

Validate to Earn System:

Earn rewards by validating claims

Get Invite

to Validate

Validate

Accuracy

Earn Valuable

Points

Points in USD Currency

Why Do You Need Excess Protect?

Excess Protect is an additional layer of risk management that safeguard you against unexpected expenses in the event of an accident. You will remain financially secure with our zero loss policies, giving you a total peace of mind.

Get in Contact

We’re happy to answer any questions you may have and help you determine which of our services best fits your needs!